Personalized Apartment/House

Packages

Credit Evaluation

Run a credit/consumer report to determine what needs to be done.

Construct Personalized Package

Once we target what you need, we will build a personalized package for you.

Get Results

Our 5 star customer service team will assist you until you sign a lease.

ABOUT US

Repair, Rebuild, Get Approved!

Our company has been assisting individuals for over 10 years now with the approval process. We know how stressful the moving process can be, and we are here to lift the burden for you and make everything as quick and stress free as possible.

WHY CHOOSE US

Who Can Benefit From Our Services

Individuals With Broken Leases

Individuals With Evictions

Individuals With Bad Credit

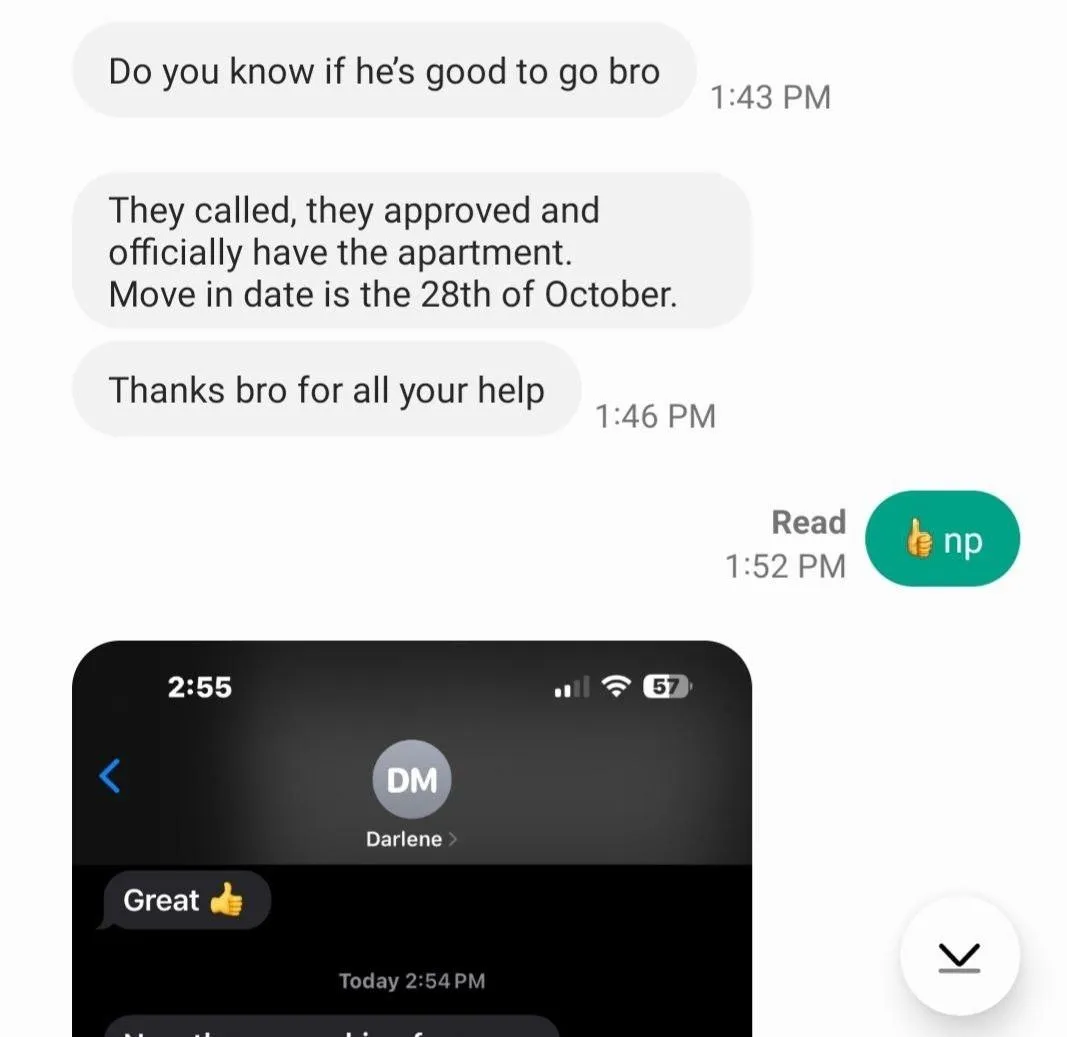

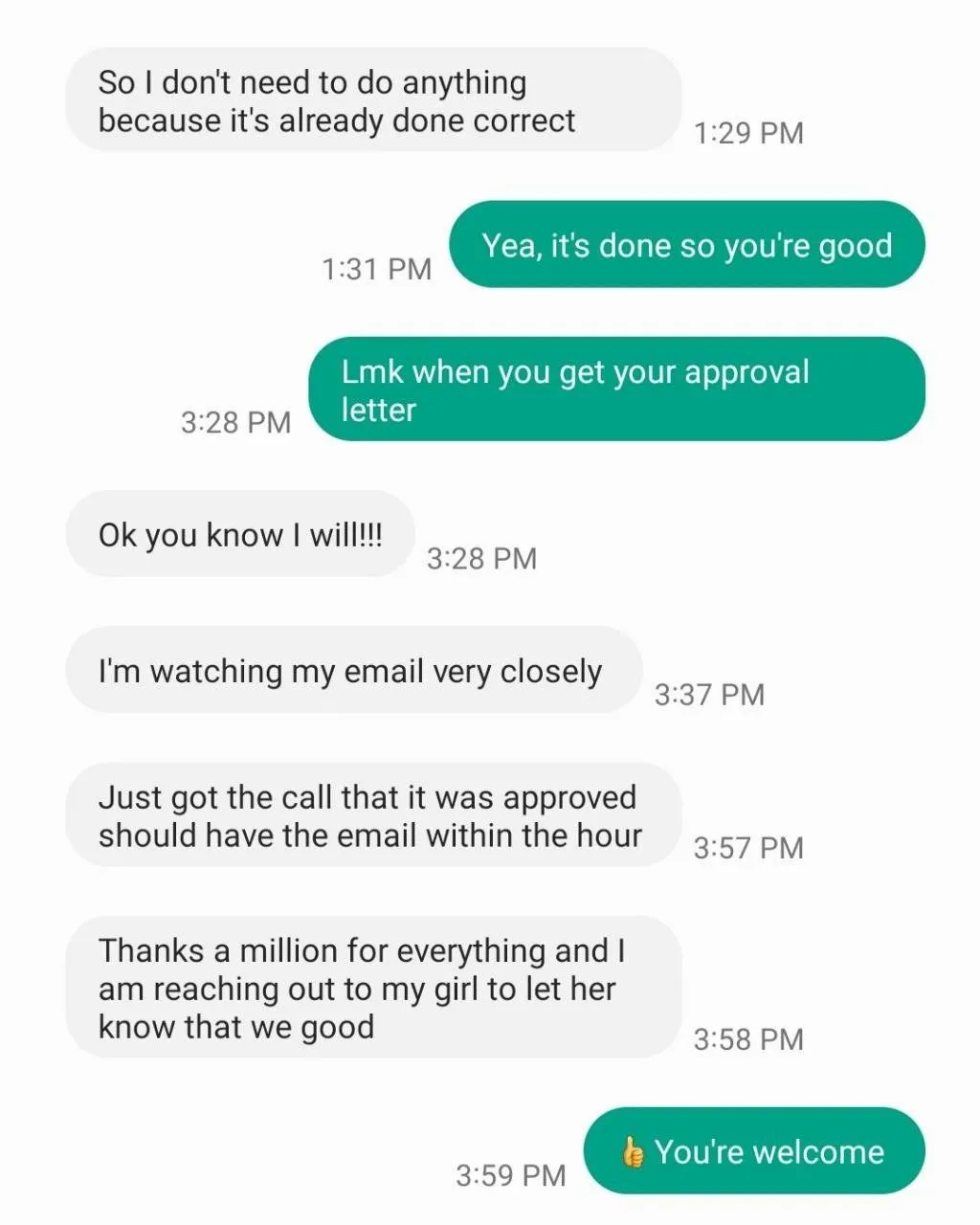

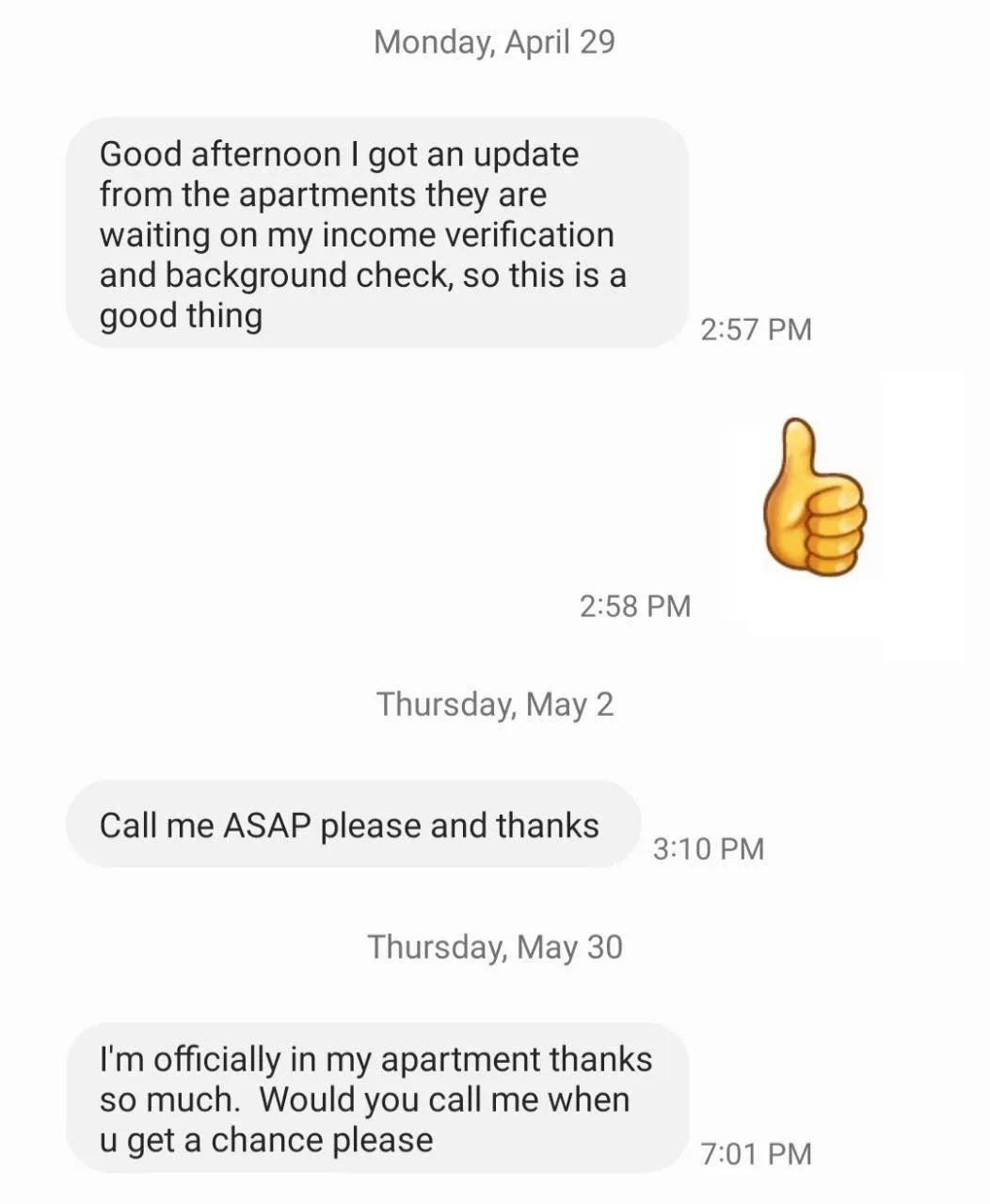

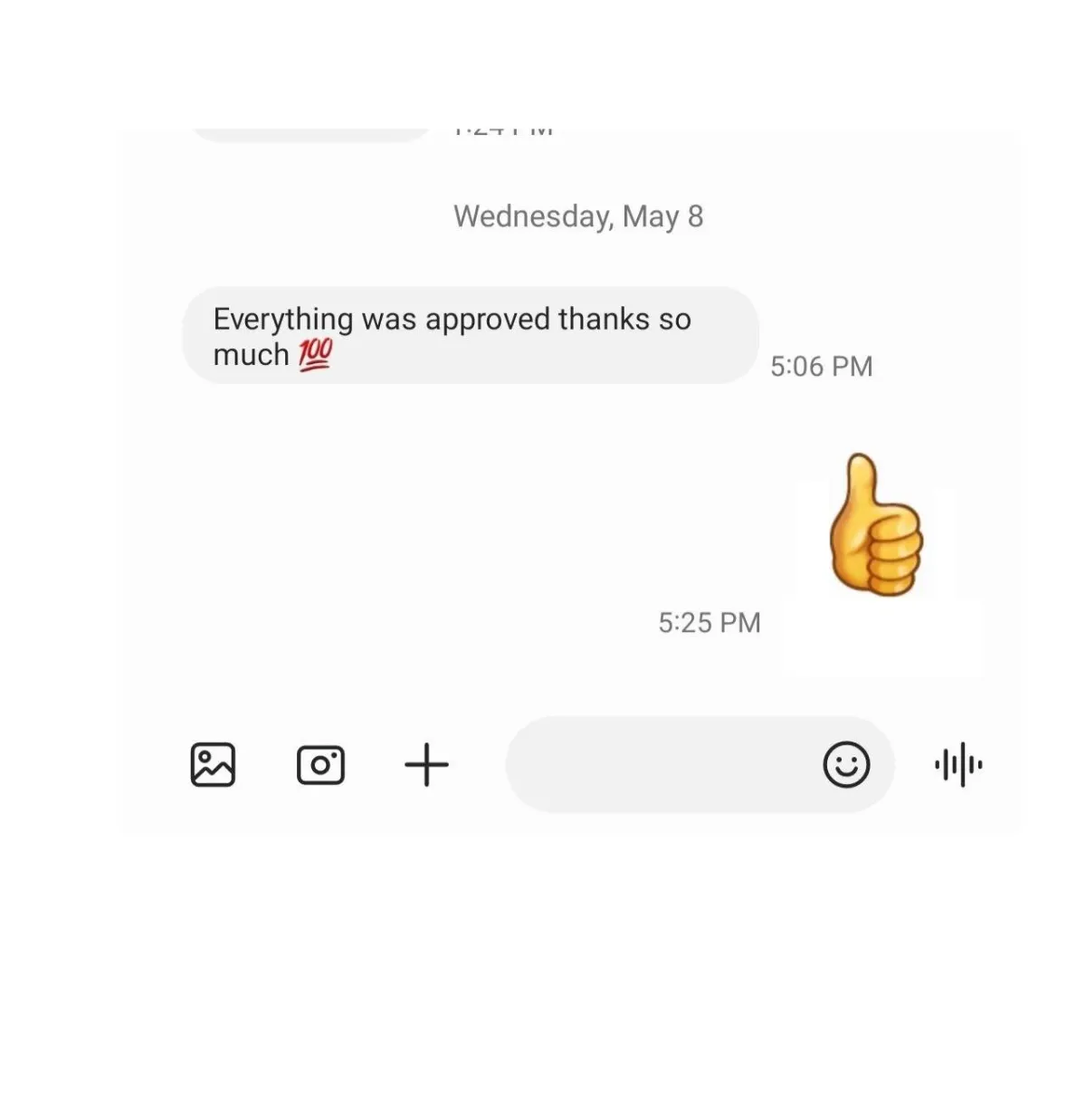

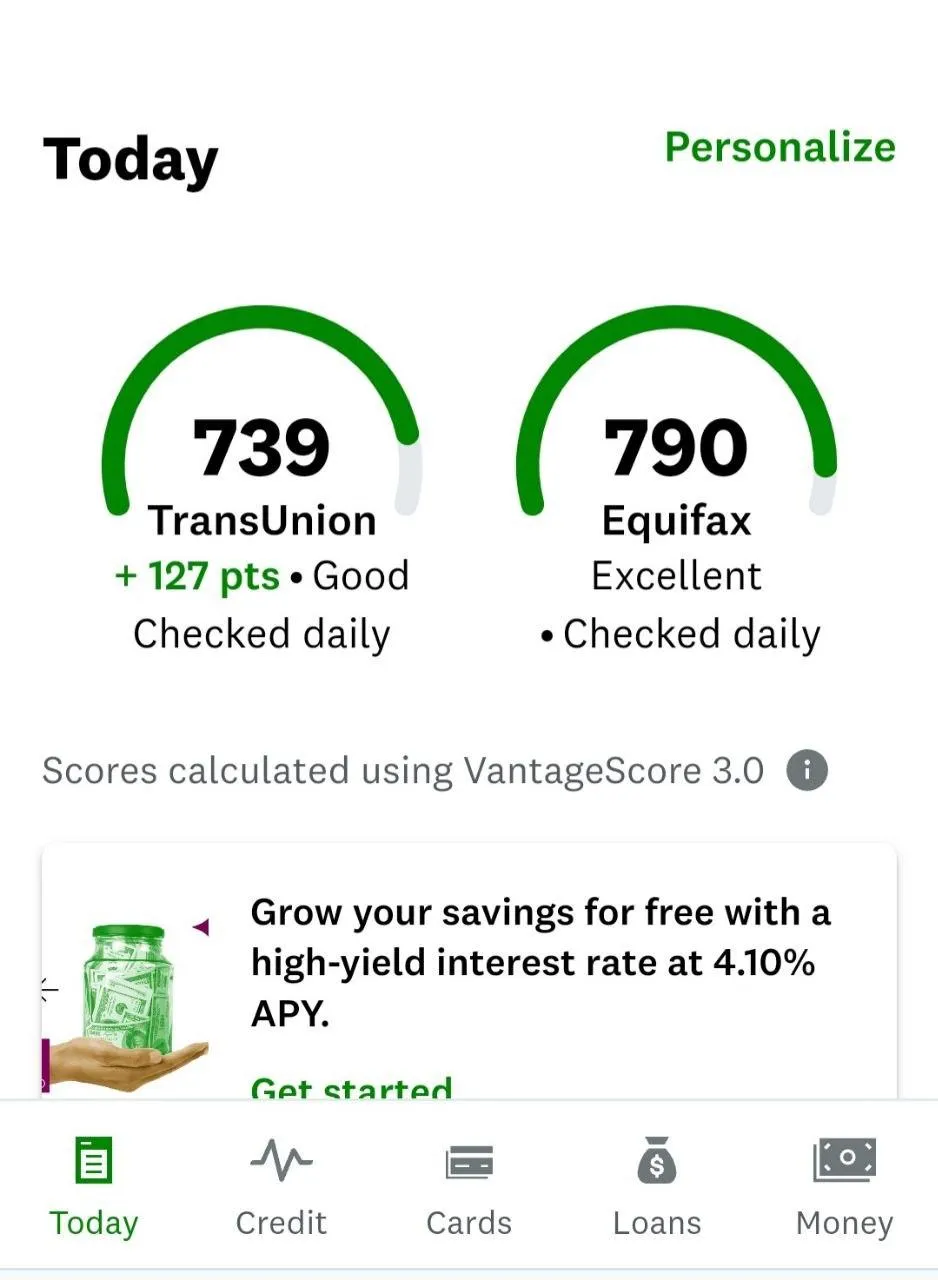

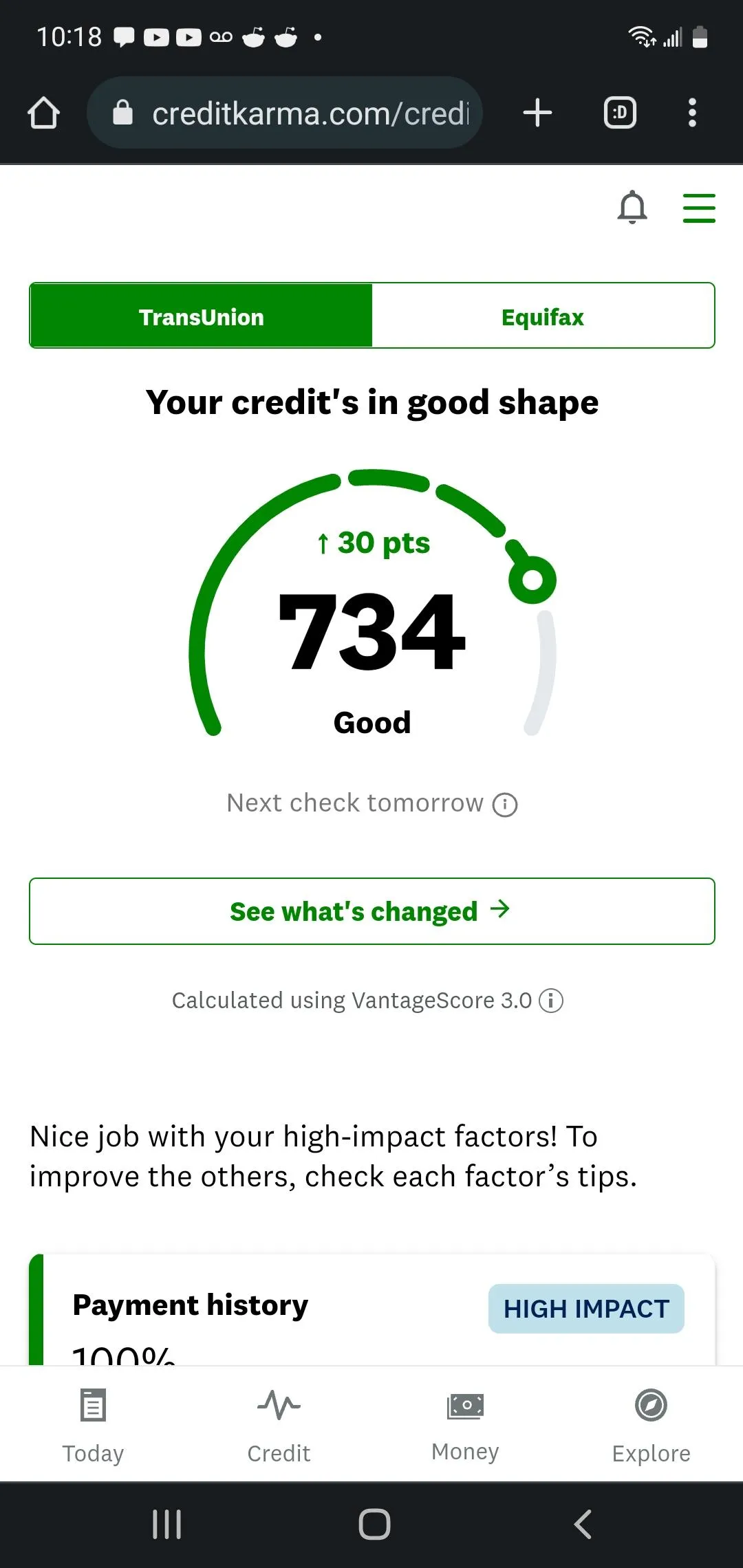

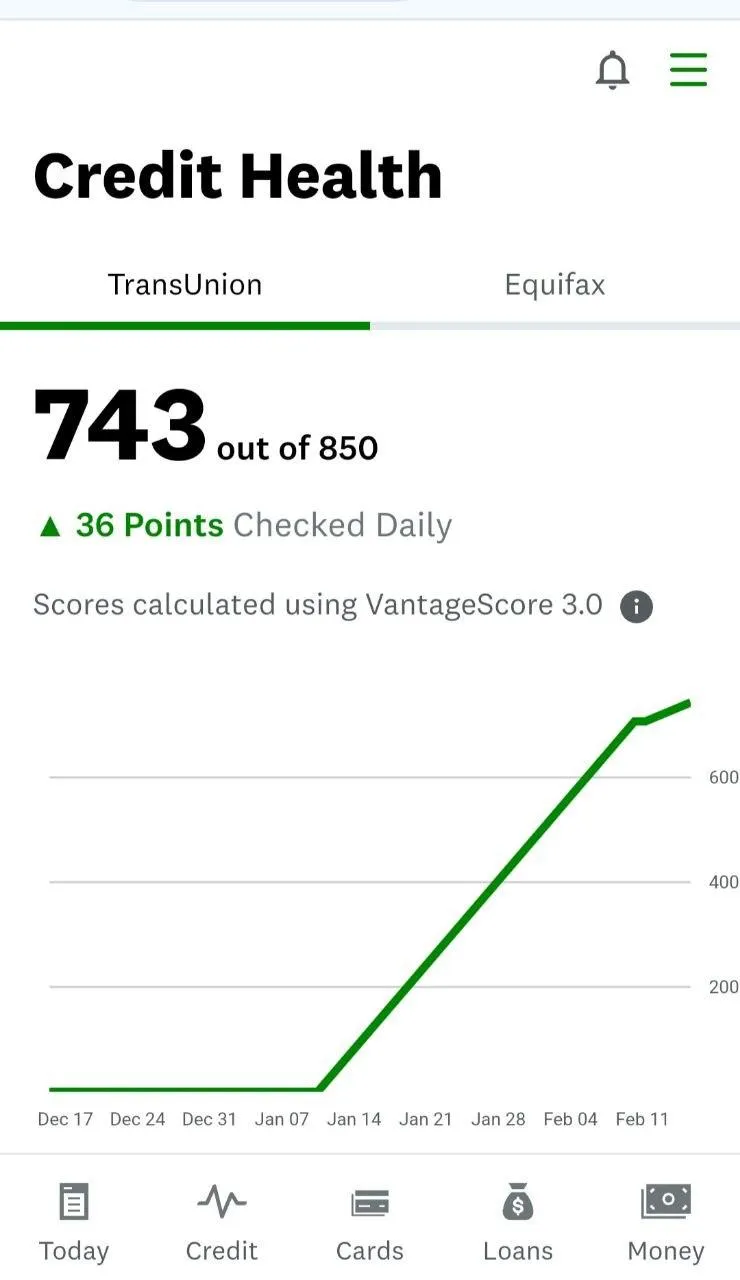

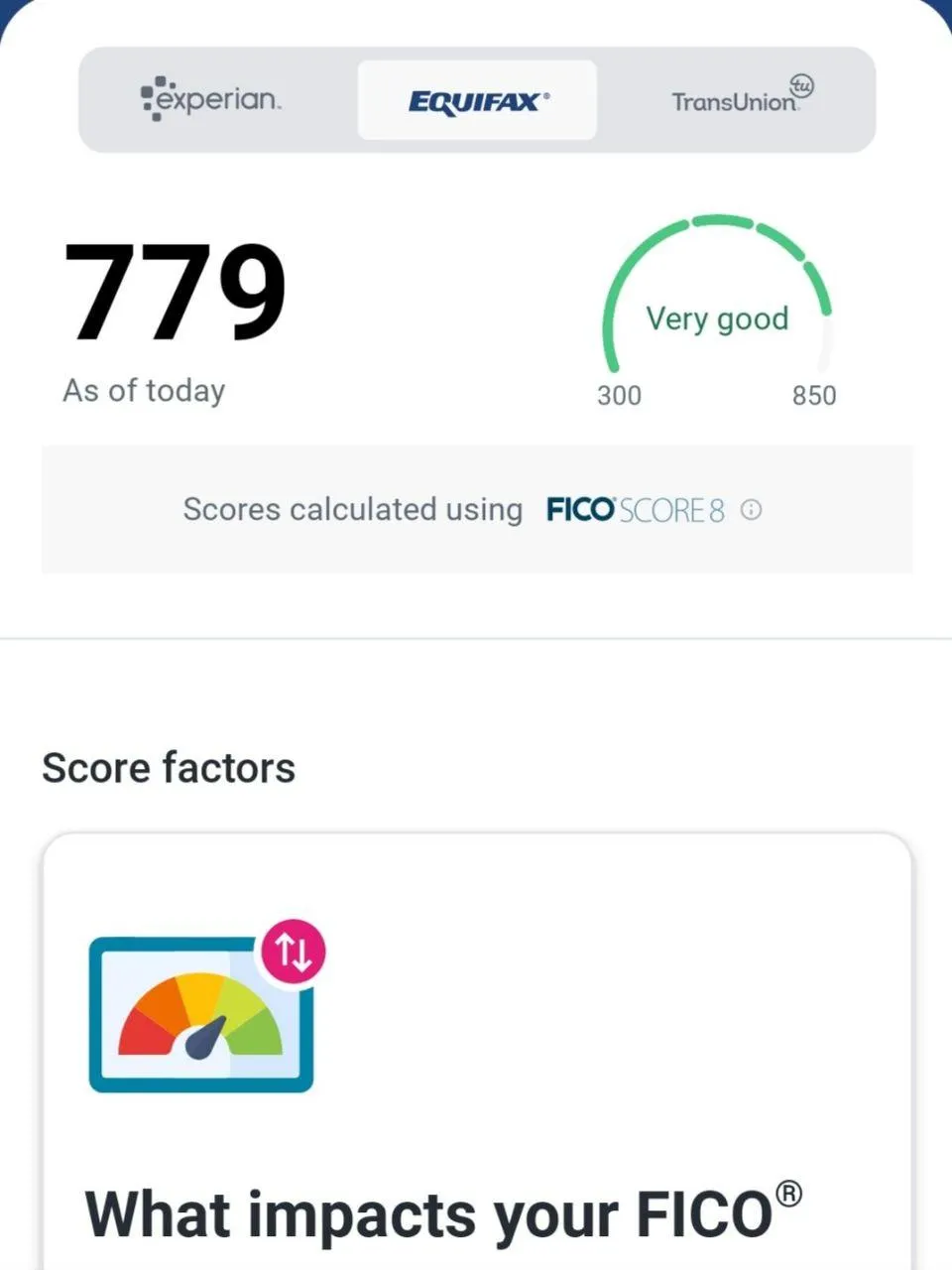

Proven Results

Gallery